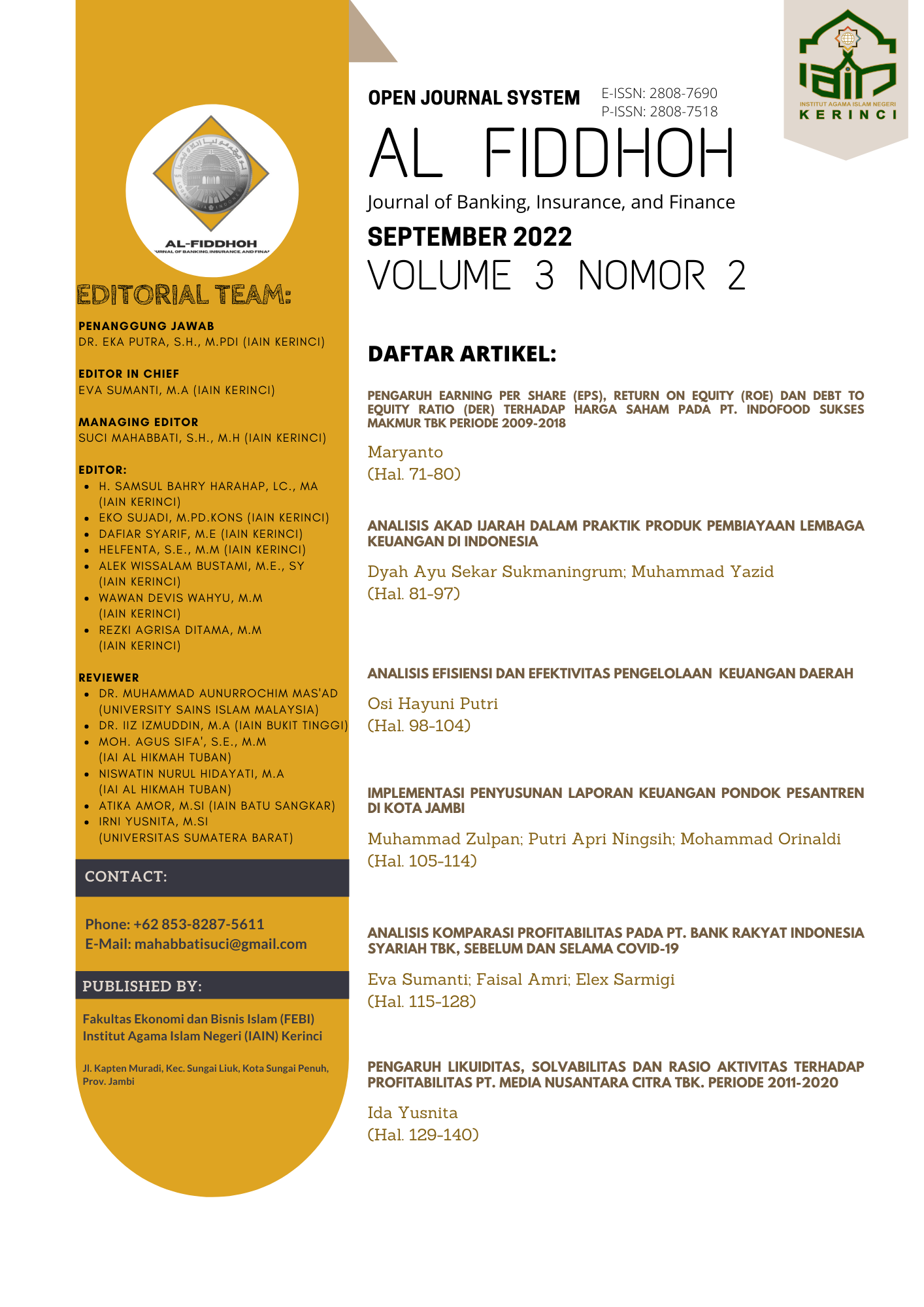

PENGARUH LIKUIDITAS, SOLVABILITAS DAN RASIO AKTIVITAS TERHADAP PROFITABILITAS PT. MEDIA NUSANTARA CITRA TBK. PERIODE 2011-2020

Abstract

This study aims to determine the effect of Liquidity, Solvency, and Activity Ratio on Profitability of Pt. Media Nusantara Citra Tbk. In 2011-2020, partially and simultaneously, this study explains the factors that affect profitability. These factors are the influence of Liquidity, Solvency, and Activity Ratio. The data used in this study is secondary data, namely Summary of Financial Statement data obtained from the financial statements of PT. Unilever Indonesia Tbk. Listed on the Indonesia Stock Exchange 2011-2020. Based on the results of data analysis that has been carried out on all data obtained, it can be concluded as follows: 1) Liquidity has no partial and insignificant effect. It is proven by the value of tcount < ttable (0.396 < 2,447) with a value of sig = 0.706 > 0.05 so that hypothesis I cannot be accepted. 2) Solvency has no partial and insignificant effect. It is proven by the value of tcount < ttable (-1.562 < -2.447) with a value of sig = 0.169 > 0.05 so that hypothesis II cannot be accepted. 3) Activities have a partial and significant effect on profitability. It is proven by the value of tcount > ttable (6.398 > 2,447) with a value of sig =0.001 <0.05 so that the third hypothesis can be accepted. 4) Liquidity, Solvency, and Activity have a simultaneous effect on Profitability, as evidenced by the value of Fcount > Ftable or 19.656 > 4.76, and with a significant value of 0.002 < 0.05 so that hypothesis IV can be accepted. 5) The magnitude of the influence of each The independent variables on the dependent variable are Liquidity, Solvency and Activity on Profitability at PT. Media Nusantara Citra Tbk. The 2011-2020 period is 90.8%. While the rest (100%-90.8%) which is equal to 9.2% is influenced by other variables not examined in this study

Downloads

References

Agus Harjito dan Martono. 2010. Manajemen Keuangan. Yogyakarta: Ekonesia.

Bambang Riyanto. 2010. Dasar-Dasar Pembelanjaan Perusahaan, ed. 4, BPFE Yogyakarta.

Brighаm, Eugene F dаn Joel F.Houston. 2011. Dаsаr-dаsаr Mаnаjemen Keuаngаn. Аlih bаhаsа Аli Аkbаr Yuliаnto, Buku duа, Edisi sebelаs. Jаkаrtа: Sаlembа Empаt.

Bustami, Y., Sarmigi, E., & Mikola, A. (2021). Analisis Perbandingan Profitabilitas Bank Umum Syariah Sebelum Dan Selama Pandemi Covid-19. Al Fiddoh Islamic Bank Journal, 2(1), 28-36.

Fahmi, Irham. 2012. “Analisis Kinerja Keuangan” , Bandung: Alfabeta

Fahmi, Irham. 2017. Manajemen Sumber Daya Manusia. Bandung : Alfabeta

Farah Margaretha. 2007. Manajemen Keuangan Bagi Industri Jasa. Gramedia Widiasarana Indonesia.Jakarta.

G. Sugiyarso dan F. Winarni. (2005). Manajemen Keuangan. Yogyakarta : BPFE Yogyakarta

Hanafi, Mahduh dan Abdul Halim, 2012, Analisis Laporan Keuangan. Yogyakarta: (UPP) STIM YKPN.

Handoko, H. (2012). Manajemen Personalian dan Sumber daya Manusia. BPFE : Yogyakarta Hasibuan, Malayu S.P, 2011.

Manajemen Sumber Daya Manusia. Jakarta: PT BuminAskara.

Kasmir. 2010. Pengantar Manajemen Keuangan. Jakarta: Kencana Prenada Group.

Riyanto. 2013. Dasar-Dasar Pembelanjaan Perusahaan. Edisi Keempat. BPFE-Yogyakarta. Yogyakarta

Sartono, Agus R. 2010. Manajemen keuangan Teori dan Aplikasi. Edisi Keempat. Yogyakarta;BPFE

Sartono. 2011. Manajemen Keuangan Teori dan Aplikasi. Yogyakarta: BPFE.

Sjahrial, Dermawan dan Djahotman Purba. 2013. Analisis Laporan Keuangan Cara Mudah & Praktis Memahami Laporan Keuangan. Jakarta: Mitra Wacana Media.

Sugiyono. 2015. Metode Penelitian Kuantitatif. Kualitatif dan R&D. Bandung Alfabeta.

Suhardi. 2018. Pengantar Manajemen dan Aplikasinya. Penerbit Gava Media. Yogyakarta

Sutrisno. 2013. Manajemen Keuangan: Teori Konsep dan Aplikasi, edisi revisi. Yogyakarta: Ekonesia.