The Influence of Economic Value Added (EVA), Market Value Added (MVA) And Company Value On Stock Prices PT. Bank Panin Dubai Syariah

Abstract

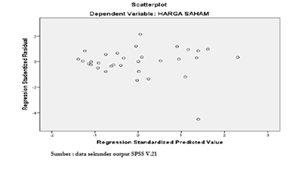

Share price is an indicator of the success of running a company. When a company's share price rises, investors believe the company is successful in managing its business. If share prices continue to fall, it means the company has not succeeded in increasing its company value. This research aims to determine the influence of each variable Economic Value Added (EVA), Market Value Added (MVA), and Company Value on the share price of PT. Bank Panin Dubai Syariah both partially and simultaneously. This research is quantitative research with a correlational approach (correlation), the research data source is secondary data in the form of financial reports and share prices of the company PT. Bank Panin Dubai Syariah quarter 2014-2021. Data hypothesis testing in this study uses multiple linear regression tests. Data analysis includes classical assumption tests, multiple regression analysis, F tests and T tests. The results of the research reveal that the Economic Value Added (EVA) variable has a significant and negative effect on stock prices, EVA produces value negative, indicating that the company's performance and ability to generate wealth have not been achieved for the company and investors. The Market Value Added (MVA) variable has no significant and negative effect on stock prices. MVA produces a negative value which indicates that the company's main goal of increasing shareholder wealth has not been achieved. Meanwhile, the company value variable (PBV) produces a significant and positive value which indicates the share price is below 1, which means the share price is undervalued or relatively cheap.

Downloads

References

Adilla, N., Afni, Z., & Siskawati, E. (2023). Pengaruh Corporate Social Responsibility (CSR), Likuiditas, Dan Pertumbuhan Penjualan Terhadap Profitabilitas Perusahaan Pada Perusahaan Sektor Barang Baku Yang Terdaftar Di Bursa Efek Indonesia Tahun 2018-2021. Jurnal Akuntansi, Bisnis Dan Ekonomi Indonesia (JABEI), 2(1), 13–24. Https://Doi.Org/10.30630/Jabei.V2i1.74

Anggara, V. (2019). Analisis Pengaruh Economic Value Added, Market Value Added, Dan Likuiditas Terhadap Return Saham Pada Perusahaan Manufaktur Sub Sektor Food And Beverages. Skripsi Universitas Lampung.

Aprillia, A., Sukadana, W., & Suarjana, W. (2021). Pengaruh Economic Value Added (EVA) Dan Market Value Added (MVA) Terhadap Harga Saham Pada Perusahaan Manufaktur Yang Terdaftar Di Bursa Efek Indonesia Periode 2017-2019. Jurnal Emas, 2(1), 51–70.

Argeswara, D. R. (2020). Economic Value Added, Dan Market Value Added Sebagai Ukurankinerja Keuangan Perusahaan (Studi Pada Perusahaan LQ45 Yang Terdaftar Di BEI Periode 2016-2018). Jurnal Ilmiah Mahasiswa FEB, 1–19. Https://Jimfeb.Ub.Ac.Id/Index.Php/Jimfeb/Article/View/6433

Cahyandari, A., Yusuf, H. F., & Rachmawati, L. (2021). Analisis Economic Value Added (Eva), Financial Value Added (Fva) Dan Market Value Added (Mva) Sebagai Alat Ukur Kinerja Keuangan. JIAI (Jurnal Ilmiah Akuntansi Indonesia), 6(2), 32. Https://Doi.Org/10.32528/Jiai.V6i2.5713

Darmawan, A., Widyasmara, M. Y., Rejeki, S., Aris, M. R., & Yasin, R. (2019). Pengaruh Likuiditas, Profitabilitas, Dan Ukuran Perusahaan Terhadap Kebijakan Deviden Dan Harga Saham. Jurnal Ilmiah FE-UMM, 13(1), 24–33.

Dewantari, N. L. S., Cipta, W., & Susila, G. P. A. J. (2020). Pengaruh Ukuran Perusahaan Dan Leverage Serta Profitabilitas Terhadap Nilai Perusahaan Pada Perusahaan Food And Beverages Di Bei. Prospek: Jurnal Manajemen Dan Bisnis, 1(2), 74. Https://Doi.Org/10.23887/Pjmb.V1i2.23157

Dian Ratnasari Yahya. (2021). Pengaruh Economic Value Added (EVA) Dan Market Value Added (MVA) Terhadap Harga Saham. CEMERLANG : Jurnal Manajemen Dan Ekonomi Bisnis, 1(4), 69–80. Https://Doi.Org/10.55606/Cemerlang.V1i4.349

Fauzan, M., & Suhendro, D. (2018). Peran Pasar Modal Syariah Dalam Mendorong Laju Pertumbuhan Indonesia. Prosiding SENDI_U, 1(1), 521–533. Http://Jurnal.Uinsu.Ac.Id/

Hartono. (2019). Economic Value Added (Eva) Dan Market Value Added (Mva) Sebagai Alat Ukur Kinerja Perusahaan. Jurnal Ekonomi, 3(2), 221–236. Https://Doi.Org/10.18860/Iq.V3i2.249

Irfan, M., & Kharisma, F. (2020). Pengaruh Price To Book Value Terhadap Harga Saham Pada Perusahaan Manufaktur Yang Terdaftar Di BEI. Borneo Student Research, 1(2), 1105. Https://Journals.Umkt.Ac.Id/Index.Php/Bsr/Article/Download/876/423

Jamaluddin Majid, Gagaring Pagalung, & Andi Ruslan. (2022). Faktor-Faktor Menentukan Harga Saham Syariah Pada Daftar Saham Terdaftar Di Index Saham Syariah Indonesia. Al-Mashrafiyah: Jurnal Ekonomi, Keuangan, Dan Perbankan Syariah, 6(1), 41–52. Https://Doi.Org/10.24252/Al-Mashrafiyah.V6i1.27769

Kotleria, F. (2020). Pengaruh Ukuran Perusahaan. Galang Tanjung, 3(2504), 1–9.

Lisnawati, I., Made, A., & Dianawati, E. (2020). Pengaruh Kebijakan Dividen, Kebijakan Hutang Terhadap Harga Saham Dan Nilai Perusahaan Sebagai Variabel Intervening (Studi Pada Perusahaan Manufaktur Yang Terdaftar Di Bursa Efek Indonesia Periode 2013-2015). Jurnal Riset Mahasiswa Akuntansi, 6(2), 1–20. Https://Doi.Org/10.21067/Jrma.V6i2.4226

Mukhlis, A., & Zahra, N. P. (2019). Analisis Kinerja Keuangan Dengan Menggunakan Rasio-Rasio Keuangan Dan Economic Value Added (EVA) Pada PT. Bank Muamalat Indonesia Tbk. Majalah Ilmiah Bijak, 16(2), 121–130. Https://Doi.Org/10.31334/Bijak.V16i2.514

Murdiyanto, E. (2020). Metode Penelitian Kualitatif (Sistematika Penelitian Kualitatif). In Yogyakarta Press. Http://Www.Academia.Edu/Download/35360663/METODE_PENELITIAN_KUALITAIF.Docx

Mutiarani, Niki Nony. Dewi, R. R. . S. (2019). Pengaruh Price Earning Ratio, Price To Book Value, Dan Inflasi. Edunomika, 03(02), 433–443.

Nurcahya, M. (2021). Pengaruh Economic Value Added (EVA), Market Value Added (MVA) Dan Likuiditas Terhadap Harga Saham Pada Perusahaan Kelompok Indeks LQ45 Di Bursa Efek Indonesia. Skripsi, 1–103.

Padilah, T. N., & Adam, R. I. (2019). Analisis Regresi Linier Berganda Dalam Estimasi Produktivitas Tanaman Padi Di Kabupaten Karawang. FIBONACCI: Jurnal Pendidikan Matematika Dan Matematika, 5(2), 117. Https://Doi.Org/10.24853/Fbc.5.2.117-128

Rahmadewi, P. W., & Abundanti, N. (2018). Pengaruh Eps, Per, Cr Dan Roe Terhadap Harga Saham Di Bursa Efek Indonesia. E-Jurnal Manajemen Universitas Udayana, 7(4), 2106. Https://Doi.Org/10.24843/Ejmunud.2018.V07.I04.P14

Rahmadi. (2011). Pengantar Metodologi Penelitian. In Antasari Press. Https://Idr.Uin-Antasari.Ac.Id/10670/1/PENGANTAR METODOLOGI PENELITIAN.Pdf

Rahmi, P. P., Aryanti, A. N., Purnomo, B. S., & Purnamasari, I. (2022). Analisis Return On Assets ( ROA ) Dan Economic Value Added ( EVA ) Dalam Menilai Kinerja Keuangan. Jurnal Manajemen, 14(4), 836–843.

Sari Sasi Gendro, Dea Aulya. (2022). Buku Metode Penelitian Kualitatif & Kuantitatif. In LP2M UST Jogja (Nomor March).

Sulastiarini, M., & Gustyana, T. T. (2019a). Pengaruh Economic Value Added ( Eva ) Dan Market Value Added ( Mva ) Terhadap Harga Saham Pada Perusahaan Makanan Dan Minuman Yang Terdaftar Di Bursa Efek Indonesia Tahun 2013-2017. Jurnal E-Proceding Of Management, 6(2), 2425–2430.

Sulastiarini, M., & Gustyana, T. T. (2019b). Pengaruh Economic Value Added (Eva) Dan Market Value Added (Mva) Terhadap Harga Saham Pada Perusahaan Makanan Dan Minuman Yang Terdaftar Di Bursa Efek Indonesia Tahun 2013-2017 The Effect Of Economic Value Added (Eva) And Market Value Added (Mva) On Stock. 6(2), 2425–2430.

Copyright (c) 2024 Fauzan Al Rafi, Samsul, Supriadi

This work is licensed under a Creative Commons Attribution 4.0 International License.